Choosing how to raise capital is one of the most important decisions a founder makes. Debt financing (loans) preserves ownership but requires repayment; equity financing (selling shares) brings cash and partners but dilutes control. This post walks you through both options, shows when each fits best, and gives a simple decision framework so you can choose with confidence.

What You’ll Learn

- Clear definitions of debt and equity financing

- Pros, cons, and real examples for each option

- How to choose based on cash flow, growth goals, and control

- Hybrid and creative funding options

1. What Is Debt Financing?

Debt financing means borrowing money you must repay with interest. Lenders include banks, credit unions, online lenders, and government programs. You keep ownership but accept fixed payment obligations.

Common Types of Debt Financing

- Term loans — a lump sum repaid over months/years.

- Lines of credit — flexible access up to a limit.

- Business credit cards — short-term revolving credit.

- Government-backed loans — e.g., SBA-style programs (lower rates, longer terms).

Debt: Pros & Cons

- Pros: Keep full ownership, interest may be tax-deductible, predictable payments help budgeting.

- Cons: Repayments come regardless of revenue, may require collateral, missed payments hurt credit.

Example: A bakery borrows $60,000 to expand. Monthly payments are fixed; owners retain 100% equity but must meet obligations even in slow months.

2. What Is Equity Financing?

Equity financing means selling a portion of your business in exchange for capital. Investors—angels, VCs, private equity, or the crowd—become co-owners and share upside (and downside).

Common Types of Equity Financing

- Angel investors — wealthy individuals who invest early and often advise.

- Venture capital — firms funding high-growth startups for larger stakes.

- Equity crowdfunding — many small investors buying shares online.

- Strategic investors — corporations investing for strategic alignment.

Equity: Pros & Cons

- Pros: No required repayments, access to investor expertise and networks, risk is shared.

- Cons: Loss of control, profit-sharing with investors, legal and governance complexity, ownership dilution over rounds.

Example: A health-tech startup sells 25% equity for $1M. The capital accelerates growth, but founders accept shared governance and future dilution risk.

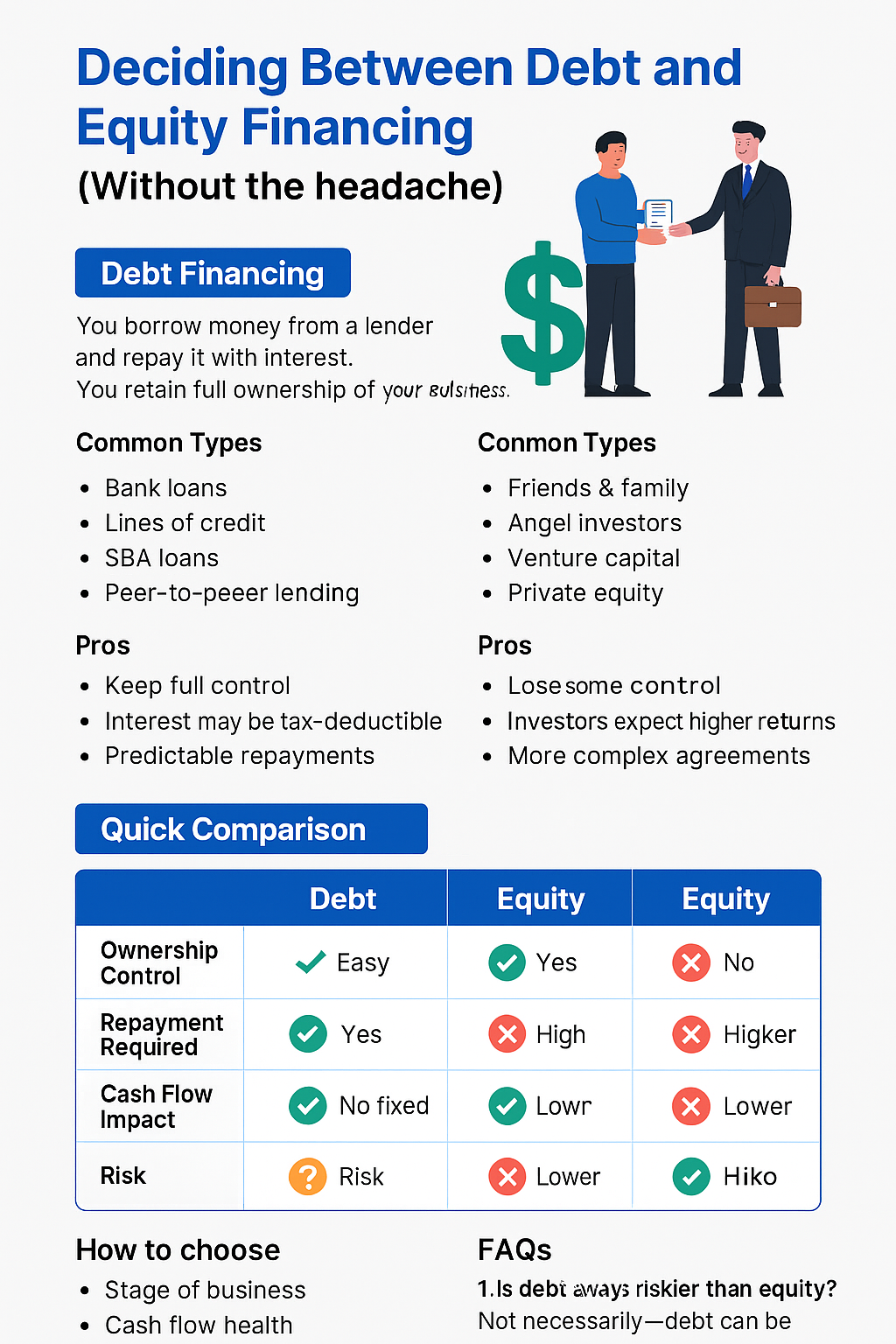

3. Quick Comparison: Debt vs Equity

| Factor | Debt Financing | Equity Financing |

|---|---|---|

| Ownership | Retain 100% | Give up part |

| Repayment | Required (principal + interest) | No scheduled repayments |

| Cash Flow Impact | Fixed obligations | No fixed obligations |

| Risk | Concentrated on owner (if revenue dips) | Shared with investors |

| Speed to close | Often faster if creditworthy | Slower—negotiation & diligence |

| Best for | Established businesses with steady cash flow | High-growth startups or businesses needing strategic support |

4. How to Decide — A Practical Framework

Use these seven checkpoints to guide your decision:

- Cash flow stability: Stable ? debt is feasible; unstable ? consider equity.

- Control tolerance: Want full control ? prefer debt; open to guidance ? equity.

- Amount needed: Small to medium sums often align with debt; large-scale scaling often needs equity.

- Speed: Need cash quickly ? debt; if you can wait for better terms and strategic partners ? equity.

- Growth goals: Short-term working capital ? debt; long-term scaling ? equity.

- Risk appetite: Comfortable carrying repayment risk ? debt; prefer shared risk ? equity.

- Market conditions: Low interest rates favor debt; active investor markets favor equity.

5. Hybrid & Creative Options

You don’t have to pick only one. Common hybrids reduce downside and preserve upside:

- Convertible debt: Loan that converts to equity at a later round or event (good for early-stage fundraising).

- Revenue-based financing: Repay a fixed share of monthly revenue until a cap is reached—no equity given.

- Mezzanine financing: Subordinated debt with equity kickers (used for growth without immediate dilution).

- Structured earn-outs: Seller receives part of price contingent on future performance (common in M&A).

6. Real-World Scenarios

Scenario A — Stable restaurant with steady profits: Likely better with debt (term loan or line of credit) to expand seating or buy equipment. Predictable cash flow supports repayments and preserves ownership.

Scenario B — Early-stage SaaS with rapid growth potential: Equity financing (angels or VC) makes sense. The business needs product and user growth capital and benefits from investor networks.

Scenario C — Mid-sized manufacturer needing new plant + working capital: Blend equity for capital-intensive plant and debt (short-term line) for working capital—this balances dilution and cash-flow needs.

7. Due Diligence & Terms to Watch

- Debt terms: interest rate, amortization schedule, covenants, collateral, prepayment penalties.

- Equity terms: valuation, dilution schedule, liquidation preferences, board seats, protective provisions.

- Negotiate: For debt, aim for flexible covenants; for equity, protect founder control with voting structures where appropriate.

8. Practical Tips Before You Raise Capital

- Prepare clean financials: 12–24 months of P&L, cash flow statements, balance sheets, and forecasts.

- Model multiple scenarios: Base / optimistic / conservative—show sensitivity to revenue, margin, and cost changes.

- Understand all costs: Interest + fees for debt; dilution and expected returns for equity.

- Get advisors: Lawyer for term sheets, accountant for tax implications, and a financial adviser for structure.

9. Infographic — Debt vs Equity at a Glance

10. FAQs

Is debt always cheaper than equity?

Not always. Debt can be cheaper in interest cost terms, but if repayment risk forces a poor outcome or bankruptcy, the effective cost is much higher. Equity’s cost is future profit sharing and dilution—both have trade-offs.

Can I mix debt and equity?

Yes. A blended approach is common and often the most practical—use equity for growth capital and debt for working capital or equipment.

How much equity should I give up?

That depends on valuation, investor value-add, financing amount, and future fundraising plans. Aim to preserve enough founder equity to stay motivated, while offering a fair share to attract quality investors.

Final takeaway

There’s no universal answer to debt vs equity. Base your decision on cash flow stability, control preferences, amount required, and strategic value investors bring. When in doubt, run scenario models, seek experienced advisors, and consider a hybrid approach.

Other Posts

- The New Gold Coin for Ghana (GGC): Value, Benefits, and How to Buy

- How to Pay Less Tax in Ghana: Smart Income Tax Planning Strategies for 2025 and beyond

- How to Reduce Your Taxable Income Legally in Canada: 2025 Legal Tax Hacks

- Slash Your IRS Bill: 10 Legal U.S. Tax Reduction Strategies for 2025

- Pension Benefits in Ghana: How to Maximize Your Retirement Contributions

- How to Reduce Your UK Income Tax Bill: 10 Smart Legal Strategies

- Ghana’s 2026 VAT Update: Understand the New Rate and Its Business Impacts

- Gold Soars Above $3,300 as US Chip Export Curbs to China Trigger Market Sell-Off

- US Tightens Chip Export Rules to China: What It Means for Global Chipmakers

- Exchange Rates: How Currencies Gain or Lose Value

- Training for Speed: Expert Tips to Improve Your Sprinting Performance

- SMART Fitness Goals: The Key to Staying Motivated and Reaching Your Fitness Potential

- Fitness Tracking Devices: Do You Really Need a Smartwatch?

- Enhance Your Training with Wearable Fitness Tech: Track, Improve, Achieve

- Why Recovery Matters: Understanding the Role of Rest Days for Fitness Progress

- Fitness Strategies: How to Build Lean Muscle Effectively

- Maximize Your Workout Results: Top Foods to Eat Before and After Exercise

- Real Estate Crowdfunding: A Low-Cost Way to Invest in Real Estate

- Real Estate Investing Strategies: How to Flip Houses & Build Passive Rental Income

- Mobile Payments: The Future of Fast and Secure Transactions

- AI in Finance: How Artificial Intelligence is Revolutionizing Financial Services

- The Future of Insurance: How InsurTech is Disrupting Traditional Models

- Understanding Your Financial Behavior: The Psychology of Money & How to Manage It

- Breaking Free from Debt: Proven Strategies to Achieve Financial Freedom

- The Hidden Dangers of IoT: How to Safeguard Your Connected Devices

- IoT and Agriculture: Feeding the World with Technology

- AI Investing: Best AI Stocks to Improve your portfolio

- AI Creativity : Can Machines Truly Innovate

- IoT For Business Efficiency: Key Benefits and Applications