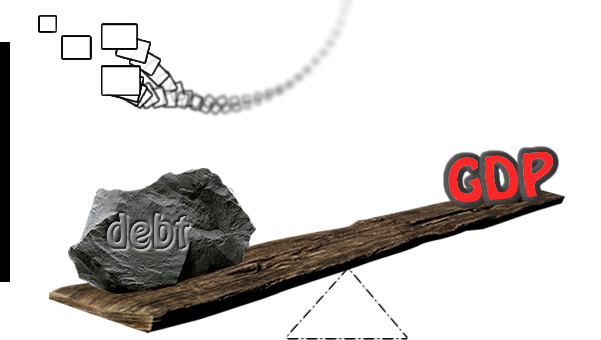

As global economies continue to evolve, many emerging nations are grappling with a significant challenge: mounting debt. While borrowing can stimulate growth, the risk of high debt default—where a country fails to meet its debt obligations—poses a serious threat to economic stability, social development, and international financial systems.

This risk is particularly relevant for growing economies that rely on external borrowing to fuel development projects and infrastructure. Debt default can lead to financial crises, rising inflation, and economic stagnation, destabilizing a nation’s economy for years to come.

In this article, we will explore the risks of high debt default, examining how it affects developing economies, the global financial system, and potential solutions to mitigate these risks.

Debt default in growing economies often occurs when countries borrow excessively without a clear plan for repayment.

Common causes include:

Understanding the Risks of High Debt Default

Debt default is the failure of a country to meet its debt obligations. When a nation defaults, it is unable to repay the borrowed money, leading to severe consequences both domestically and internationally. The risks are especially pronounced for growing economies, which are often more vulnerable to financial crises due to their reliance on external debt to fund development.

1. Impact on Economic Growth

For many developing nations, external debt is often used to finance large-scale infrastructure projects, such as roads, ports, and energy generation facilities. While these investments are critical for growth, when debt levels become unsustainable, the economic growth trajectory is severely disrupted. Countries facing high debt burdens may have to divert resources away from vital public services like education and healthcare to service their debts, which in turn hinders long-term growth. Key Insight: If a country defaults on its debt, international creditors may demand immediate repayment, leading to a sharp contraction in government spending, a rise in unemployment, and a slowdown in investment—factors that stifle economic growth.

2. Inflation and Currency Devaluation

High debt levels can lead to inflation and currency devaluation in developing economies. Governments may resort to printing more money to service their debt, which devalues the currency and raises inflation. This inflation increases the cost of living for citizens, particularly in countries that rely heavily on imports. Example: Countries like Argentina and Venezuela have experienced hyperinflation, where runaway prices eroded the purchasing power of their citizens, in part due to high debt levels and failure to manage debt repayment.

3. Loss of Investor Confidence

Debt defaults undermine investor confidence in a country’s economy. When investors perceive a nation as a risky investment, they are less likely to provide funding or buy bonds issued by that country. This results in higher borrowing costs and reduced foreign direct investment (FDI), both of which are vital for growth in emerging markets. Tip: Countries with high debt levels might face a credit downgrade, making future borrowing even more expensive. In turn, this can trigger a vicious cycle where the country cannot access capital on favorable terms, worsening its economic situation.

Global Financial System and the Ripple Effect

The ripple effects of high debt defaults extend beyond the borders of the nation in question. Global financial institutions, such as the World Bank, the IMF, and private creditors, have significant stakes in the economic stability of emerging markets. When a nation defaults, these institutions may need to step in to mitigate the financial damage, often leading to austerity measures, structural reforms, and other policies that can create social unrest.Global Impact: A default by a major economy, such as a Latin American or African nation, can destabilize international markets. The global supply chains might be affected, and international markets could experience volatility, especially if the default triggers a domino effect in other economies with high debt levels.

Related Questions & Answers

What are the main causes of debt default in developing countries?Debt default in growing economies often occurs when countries borrow excessively without a clear plan for repayment.

Common causes include:

- Over-reliance on external borrowing

- Declining export revenues

- Political instability

- Currency devaluation leading to unmanageable foreign debt

How can developing countries avoid defaulting on their debts?

To prevent debt default, developing nations should:- Strengthen fiscal discipline and maintain balanced budgets.

- Diversify sources of income and reduce dependency on foreign loans.

- Engage in debt restructuring negotiations with creditors to extend payment terms or reduce the principal.

- Promote sustainable development policies that encourage long-term economic growth.

What happens when a country defaults on its debt?

When a country defaults on its debt:- The national economy may enter a recession or depression.

- Inflation and unemployment typically rise.

- The country may lose access to international capital markets.

- International credit rating agencies may downgrade the country’s debt, making it harder and more expensive to borrow in the future.

What are the potential solutions to mitigate debt default risks?

- Debt Restructuring: Countries can renegotiate debt terms with creditors, extending repayment periods or reducing the debt amount.

- Diversification of Debt: Reducing reliance on external debt by promoting domestic financing options and creating sustainable revenue sources.

- Strengthening Governance: Improving transparency in financial management, reducing corruption, and ensuring that borrowed funds are used efficiently for growth projects.

Conclusion: The Challenges of High Debt Default

The risk of high debt default is a growing concern for many developing economies. While borrowing can provide immediate financial relief and stimulate growth, excessive debt can lead to a host of economic issues, including inflation, loss of investor confidence, and potential defaults.For growing economies, it is crucial to implement sound fiscal policies, diversify sources of income, and establish robust frameworks for debt management. Only through careful economic planning, sustainable development, and responsible borrowing can these nations navigate the complex risks of high debt default and achieve long-term stability and growth.

As global interconnectedness increases, the consequences of debt default in emerging markets are far-reaching. Policymakers, international organizations, and investors must work together to foster sustainable economic growth while minimizing the risks associated with debt accumulation. In doing so, we can build a more resilient global economy.Page Links

- Exchange Rate Determination: Factors That Influence Currency Value

- Training for Speed: Expert Tips to Improve Your Sprinting Performance

- SMART Fitness Goals: The Key to Staying Motivated and Reaching Your Fitness Potential

- Fitness Tracking Devices: Do You Really Need a Smartwatch?

- Enhance Your Training with Wearable Fitness Tech: Track, Improve, Achieve

- AML Compliance -Banks : Rules and Future Practices Worldwide

- KYC: Using Blockchain for Identity Verification

- HomeBuyer's Guide to Understanding Mortgages and Rental Options in the US

- PWAs vs. Native Apps: Better Performance, Cost, and User Experience?

- The Future of Driving: Top Electric Vehicles to Watch now and Beyond

- Your Guide to Identity Theft: What You Need to Know to Stay Safe

- Deep Fakes: What They Are and Why They Matter

- Why Fortnite Is Still a Gaming Powerhouse Now

- Early Retirement Made Simple: Key Tips to Retire Early and Live Your Dream Life

- Is Buying Gold a Smart Investment? Benefits, Risks, and Trends for 2024

- Why Compounding is the Ultimate Secret to Building Wealth Over Time

- Differences in How the Rich and Poor Manage Money

- Unlock Better Health: The Crucial Role of Sleep and Tips for Improving Rest

- Why a 2% Investment Return Isn't Enough: Strategies for Achieving Real Financial Growth

- Can AI Ever Match Human Intuition and Accuracy?

- How to Lose Fat and Gain Muscle with Body Recomposition

- Simply Growing and Caring for Air Plants with Benefits

- Money Transfer Operators (MTOs) and Inward Remittance Dynamics in 2 Minutes

- Understanding Layer 2 Blockchain Solutions

- Why You Should Consider Franchising

- Ethereum ETF Approval: A Game-Changer for Investors in finance?

- Lithium Mining: Meeting The Demands For a Greener World