Ghana’s tax system is undergoing major reforms. Historically, VAT was accompanied by several additional levies — NHIL, GETFund, and the COVID-19 Health Recovery Levy — creating complexity and compounding tax effects. Starting January 2026, Ghana introduces a 20% flat VAT system, eliminating all separate levies.

This guide explains the old levy structure, practical tax examples, and how the new VAT system changes everything.

1. What Are NHIL and GETFund Levies

NHIL — National Health Insurance Levy (2.5%)

A levy that supports the National Health Insurance Scheme (NHIS). It is not VAT but charged alongside VAT.

GETFund — Ghana Education Trust Fund Levy (2.5%)

A levy used to develop education infrastructure. Also not VAT but applied on the value of taxable supplies.

COVID-19 Health Recovery Levy (1%)

Introduced in 2021 to support national pandemic recovery efforts. This levy is also not deductible.

2. Key Features of the Old NHIL, GETFund & COVID-19 Levy System

- VAT-registered taxpayers cannot claim input credit on NHIL, GETFund & COVID-19 Levy.

- Goods on the 3% VAT Flat Rate are exempt from NHIL & GETFund, but not the COVID-19 Levy.

- Levies were charged at every stage of a VAT-standard supply.

- Importers were required to account for levies on imported services.

- Zero-rated supplies attracted zero-rated NHIL, GETFund & COVID-19 Levy.

3. Old VAT Computation: How It Worked

The old system used a multi-layered computation:

The Base for Levies

- Value of supply (excluding VAT)

- Including non-deductible levies

- All levies treated as costs

Taxable Value for VAT

VAT was applied on:

- Value of the supply

- Plus NHIL

- Plus GETFund

- Plus COVID-19 Levy

4. Practical Example — Old System (Before January 2026)

Assume the value of taxable supply is GH¢1,000.

Step 1: Compute Levies

| Levy | Rate | Amount (GH¢) |

|---|---|---|

| NHIL | 2.5% | 25 |

| GETFund | 2.5% | 25 |

| COVID-19 Levy | 1% | 10 |

| Total Levies | 60 |

Step 2: Compute VAT (15%)

VAT base = GH¢1,000 + GH¢60 = GH¢1,060

VAT @ 15% = GH¢159

Step 3: Final Invoice (Old System)

| Item | Amount (GH¢) |

|---|---|

| Value of Supply | 1,000 |

| Total Tax | 219 |

| Total Payable | 1,219 |

Effective tax rate 21.9%

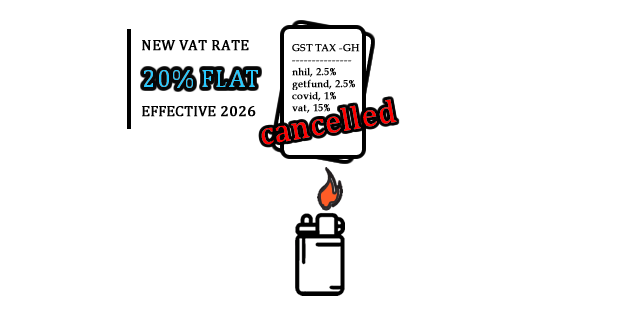

5. New VAT System — Effective January 2026

- NHIL (2.5%) removed

- GETFund (2.5%) removed

- COVID-19 Levy (1%) removed

- VAT @ 20% replaces all

No compounding. No levy stacking. No tax-on-tax.

6. Practical Example — New VAT System (January 2026 Onwards)

Assume the value of supply is GH¢1,000.

VAT @ 20% = 20% × 1,000 = GH¢200

| Item | Amount (GH¢) |

|---|---|

| Value of Supply | 1,000 |

| VAT @ 20% | 200 |

| Total Payable | 1,200 |

7. Comparison: Old vs New VAT System

| Feature | Old System | New System (Jan 2026) |

|---|---|---|

| NHIL | Yes (2.5%) | No |

| GETFund | Yes (2.5%) | No |

| COVID-19 Levy | Yes (1%) | No |

| VAT Rate | 15% (compounded) | 20% flat |

| Effective Tax | 21.9% | 20% |

| Complexity | High | Low |

For more details on the levies before the reform, visit Understanding NHIL and GETFund Levies in Ghana.

Other Posts

- The New Gold Coin for Ghana (GGC): Value, Benefits, and How to Buy

- How to Pay Less Tax in Ghana: Smart Income Tax Planning Strategies for 2025 and beyond

- How to Reduce Your Taxable Income Legally in Canada: 2025 Legal Tax Hacks

- Slash Your IRS Bill: 10 Legal U.S. Tax Reduction Strategies for 2025

- Pension Benefits in Ghana: How to Maximize Your Retirement Contributions

- How to Reduce Your UK Income Tax Bill: 10 Smart Legal Strategies

- Ghana’s 2026 VAT Update: Understand the New Rate and Its Business Impacts

- Gold Soars Above $3,300 as US Chip Export Curbs to China Trigger Market Sell-Off

- US Tightens Chip Export Rules to China: What It Means for Global Chipmakers

- Exchange Rates: How Currencies Gain or Lose Value

- Training for Speed: Expert Tips to Improve Your Sprinting Performance

- SMART Fitness Goals: The Key to Staying Motivated and Reaching Your Fitness Potential

- Fitness Tracking Devices: Do You Really Need a Smartwatch?

- Enhance Your Training with Wearable Fitness Tech: Track, Improve, Achieve

- Why Recovery Matters: Understanding the Role of Rest Days for Fitness Progress

- Fitness Strategies: How to Build Lean Muscle Effectively

- Maximize Your Workout Results: Top Foods to Eat Before and After Exercise

- Real Estate Crowdfunding: A Low-Cost Way to Invest in Real Estate

- Real Estate Investing Strategies: How to Flip Houses & Build Passive Rental Income

- Mobile Payments: The Future of Fast and Secure Transactions

- AI in Finance: How Artificial Intelligence is Revolutionizing Financial Services

- The Future of Insurance: How InsurTech is Disrupting Traditional Models

- Understanding Your Financial Behavior: The Psychology of Money & How to Manage It

- Breaking Free from Debt: Proven Strategies to Achieve Financial Freedom

- The Hidden Dangers of IoT: How to Safeguard Your Connected Devices

- IoT and Agriculture: Feeding the World with Technology

- AI Investing: Best AI Stocks to Improve your portfolio

- AI Creativity : Can Machines Truly Innovate

- IoT For Business Efficiency: Key Benefits and Applications