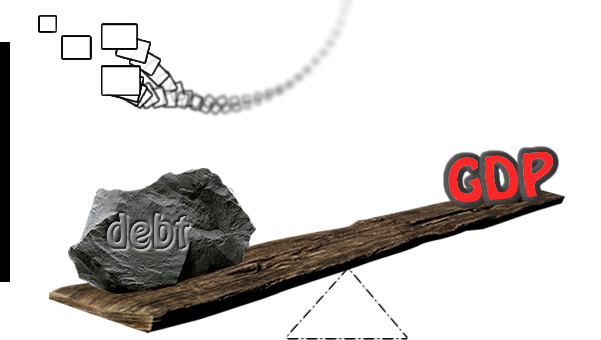

As global debt levels soar, the threat of default in growing economies poses a significant risk to global stability and future prosperity. In this article, we explore how high debt default can destabilize economies, hinder growth, and impact international markets. We’ll also look at the mechanisms that lead to this instability, examine historical examples, and discuss potential solutions for mitigating these risks.

#1: The Growing Debt Crisis in Emerging Economies

Emerging economies have increasingly relied on external borrowing to fuel their growth. However, this growing debt burden is creating significant risks. The need for infrastructure development, economic growth, and the impacts of global events like the COVID-19 pandemic are among the key factors contributing to this issue.

- Factors Contributing to Increased Borrowing: Economic growth ambitions, external shocks, and favorable borrowing conditions have led many governments to take on more debt than they can sustainably manage.

- Identifying Vulnerable Economies: Key Indicators: Rising debt service ratios, shrinking foreign reserves, and weak fiscal policies are among the key signs that a country is vulnerable to default.

#2: The Economic Fallout of Debt Default

When a country defaults on its debt, the economic fallout can be severe and long-lasting. Below are the key ways in which a debt default can impact an economy.

- Loss of Investor Confidence and Capital Flight: A default can lead to an immediate loss of investor confidence, triggering capital flight and financial instability.

- Currency Devaluation and Inflationary Pressures: Debt defaults often lead to a sharp devaluation of the national currency, resulting in inflation and eroding purchasing power.

- Disruption of Trade and Investment Flows: Sovereign defaults can sever trade relationships and deter foreign direct investment, leading to long-term economic stagnation.

- Banking Sector Instability and Financial Contagion: Defaults can trigger a banking crisis, with widespread financial instability and the potential for contagion to neighboring economies.

#3: The Broader Impact: Social and Political Ramifications

The consequences of a debt default extend far beyond economic damage. These crises can lead to significant social and political

Other Posts

- The New Gold Coin for Ghana (GGC): Value, Benefits, and How to Buy

- How to Pay Less Tax in Ghana: Smart Income Tax Planning Strategies for 2025 and beyond

- How to Reduce Your Taxable Income Legally in Canada: 2025 Legal Tax Hacks

- Slash Your IRS Bill: 10 Legal U.S. Tax Reduction Strategies for 2025

- Pension Benefits in Ghana: How to Maximize Your Retirement Contributions

- How to Reduce Your UK Income Tax Bill: 10 Smart Legal Strategies

- Ghana’s 2026 VAT Update: Understand the New Rate and Its Business Impacts

- Gold Soars Above $3,300 as US Chip Export Curbs to China Trigger Market Sell-Off

- US Tightens Chip Export Rules to China: What It Means for Global Chipmakers

- Exchange Rates: How Currencies Gain or Lose Value

- Training for Speed: Expert Tips to Improve Your Sprinting Performance

- SMART Fitness Goals: The Key to Staying Motivated and Reaching Your Fitness Potential

- Fitness Tracking Devices: Do You Really Need a Smartwatch?

- Enhance Your Training with Wearable Fitness Tech: Track, Improve, Achieve

- Why Recovery Matters: Understanding the Role of Rest Days for Fitness Progress

- Fitness Strategies: How to Build Lean Muscle Effectively

- Maximize Your Workout Results: Top Foods to Eat Before and After Exercise

- Real Estate Crowdfunding: A Low-Cost Way to Invest in Real Estate

- Real Estate Investing Strategies: How to Flip Houses & Build Passive Rental Income

- Mobile Payments: The Future of Fast and Secure Transactions

- AI in Finance: How Artificial Intelligence is Revolutionizing Financial Services

- The Future of Insurance: How InsurTech is Disrupting Traditional Models

- Understanding Your Financial Behavior: The Psychology of Money & How to Manage It

- Breaking Free from Debt: Proven Strategies to Achieve Financial Freedom

- The Hidden Dangers of IoT: How to Safeguard Your Connected Devices

- IoT and Agriculture: Feeding the World with Technology

- AI Investing: Best AI Stocks to Improve your portfolio

- AI Creativity : Can Machines Truly Innovate

- IoT For Business Efficiency: Key Benefits and Applications